ex-Grabber on Grab (part 2)

Do note the below is not investment advice and meant for general discussion purposes. Clients of Farrer Wealth Advisors may hold some of the securities of the companies discussed below.

When Grab, my former employer, announced it would go public via a merger with the AGC SPAC, I wrote out my thoughts on the company’s future and as an investment. You can read that writeup here. Now that the company has completed the merger and officially been listed, I thought it would be a good time to revisit our thoughts on the company as they’ve released a few quarters worth of results.

Before we get into the company, the actual listing day was quite a bit of fun for current and ex-Grabbers. My social media was full of posts about people’s time and experience at the company, and many who had an affiliation to it got together and toasted. I was no exception and got together with a group of ex-Grabbers all of whom have moved on to work on exciting endeavours such as top-tier VC funds, joining media conglomerates, launching exciting start-ups, and even running an asset management business :). The catchup reminded me that one of the least talked about parts of working for a company that goes from a tiny start-up to a listed entity is the boost it gives to the careers of all those who are part of the journey, as well as the network they build.

The above photo was taken at just about that time when trading started in NYC

The listing has not gone well with regards to the stock price. The price opened at around over $11 but declined rapidly throughout the day and as of now the stock is trading at around $7.57 valuing the company at~$30bn in market cap . There were a few factors here that certainly didn’t help support the stock price, for one listing happened during a rough sell-off of growth stocks (particularly unprofitable ones), general market weakness around rising inflation/interest rates/omicron variant, and the fact that there was almost no-lockup for most Grab employees (so nearly 30% of total outstanding shares could be sold immediately). Taking all of that into account though, the company had little choice but to list now as it would have been a loss of credibility as management had promised listing by year. Any delay would have raised questions about the company’s accounts (as the company was waiting for SEC clearance w.r.t to their accounting polices[1]).

The short-term price movements though aren’t much to write about, as all we can say about them is that well, they are short-term. The bigger questions to ask now are how the company is doing, what are the prospects for the future, and what should its valuation be (at least relatively).

Luckily, we have 3 quarters of earnings to digest, and so below we’ll go through them and give you, our thoughts (we won’t go into the background of the company for that please read our previous post linked above). There is a bit of difficulty here as Grab has changed its definition of Adjusted Net Sales and then dropped it all together and instead now talks about Gross Billing and IFRS revenue, both of which makes comparisons to competitors a bit difficult, but I’ll do my best to define terms as we go along.

Covid driven re-statements:

2021 was a year of high expectations for the company, with covid meant to subside, tourism return to the region, and growth to fire on across all segments. However, the delta mutation put a stop to that, and Grab was forced to restate its 2021 guidance.

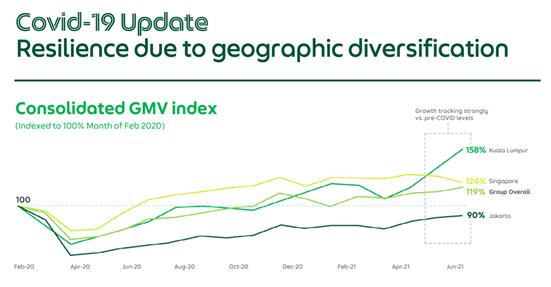

Much of the restatement was due to countries like Vietnam locking down and mobility ground to a halt. Further, while vaccinations were picking up across the region, countries have only recently started to open for tourism, dampening any serious pickup of the sector in 2021. Despite the challenging environment the company did show in its Q2 numbers that growth is picking up in the areas less affected by covid, and in some cases surpassed pre-covid numbers.

The above notwithstanding, it was a bit discouraging to see that given the lower top line guidance, the guidance for losses also increased. This implies that the company is running with bulky fixed costs and has not taken the opportunity during covid to drive more efficiency on the corporate level. While the revised guidance at the extreme ends would show an adj. EBITDA loss of -43% of revenues and the 2020 equivalent was -53%, the 2020 numbers were for actual EBITDA and not adjusted. Thus, this implies that the ratio of loss to revenues is almost similar in 2021 as was in 2020 showing a lack of operating leverage despite the GMV growth of 30%. Grab countered this with the below slide in the Q3 Presentation, however at best it shows a marginal improvement in regional costs (from -5% of GMV to -4%)

Given the current market cycle we are in and that the market is punishing the stocks of companies that are not showing a clear path to profitability, the income statement could continue to be a drag on the stock price. However, I will say that Grab hasn’t had a fair shake these last two years with covid impacting significant portions of their business, thus it will be interesting to see what the margin profile looks like in a covid-free year and if the company can prove their businesses viable without covid hampering certain verticals. Below I’ll go over each of their core business and discuss what I think are the puts and takes, and what investors think about.

Mobility

With the lockdowns its fair to say that the Mobility segment has had a rough year. The first nine months of the year saw mobility GMV fall 15%. The segment was hit by a double whammy of neither tourists nor the local population traveling within countries. That, said, the segment seems to be a profit driver, racking up US$264MM worth of adj. EBITDA during the year. I continue to be impressed by the margins that they are pulling out of the business, and as a function of GMV, adj. EBITDA is roughly around ~13% of GMV[2]. Compared to Uber and Didi whose numbers are about 5.5% and negative respectively, Grab has put up some strong numbers.

This above is mainly driven by Grab’s 70% market share in the region. I think it will be difficult for anyone to wrestle this position away from Grab, especially given a push to profitability for key competitors like GoTo as they look to go public. There is some risk coming from Didi, who’s non-compete with Grab should have expired upon the combination with Altimeter, and potentially with Uber, which will expire on year after Uber sells its shares or on March 2023. I think out of the two, if either were to try and compete with Grab, competition from Didi is more likely given their recent regulatory troubles which I suspect will result in a large push to grow their business after they’ve made up with the CCP.

The other issue with Mobility is that take rates can only be pushed so far and prices can only be raised so much, as both actions lead to political consequences. Squeeze drivers and you have a PR nightmare on your hands, raise prices and local taxis start becoming more attractive. Thus, growth must be driven by further adoption of ride-hailing around the region. Pre-covid, the penetration rate for ride-hailing was just 5.2% (versus total personal consumption expenditure on land mobility), which implies that higher adoption is almost a given.

Overall, I think Mobility will continue to be Grab’s bread and butter. They are multiples larger than their nearest competitor and seem to have an efficient business as compared to global lookalikes. As stated in our first writeup, it’s a struggle to build a ride-hailing business and takes a ground up effort with significant attention on driver relations – all this makes replicating Grab’s business daunting to say the least.

Delivery:

While Mobility has floundered, Delivery has more than made up for the losses, with Deliveries GMV up 57% yoy so far. Take rates have also improved by about 1.2% to 18.2% in Q3 this year (vs Q3 last year). This segment has been boosted by continued lockdowns meaning more ordering at home as well has significant increase in GrabMart. While we don’t know the absolute numbers for GrabMart, it seems significant enough for the company to call it out in their Q3 presentation (Grab just announced its also acquired Jaya Grocer, Malaysia’s top premium grocer, reminding us of Amazon’s Wholefoods acquisition).

While Deliveries is certainly a growth engine, it’s not an easy business. Frankly deliveries in the region are a knife fight with several competent and aggressive competitors in the mix. Grab certainly has a head start and some estimates put them at a 50% market share. But they are up against ShopeeFood in Indonesia, Vietnam, Malaysia, and Thailand. Gojek in Indonesia. FoodPanda and in Singapore, Thailand, and the Philippines. Essentially every market has a serious competitor (if not two). Further neither restaurants nor consumers have been known to show much loyalty here, as most will use several providers. Unlike its war with Uber, where Grab’s competitor was quite distracted (privacy issues, CEO outed, political battles, etc), local competitors are just as entrenched as Grab is and are not going anywhere soon. To put it in context, this tweet showed ShopeeFood’s aggression in the Indonesian market, and unlike its competitors Shopee’s parent Sea Limited has continually state that profitability is not a priority for them.

The competitive reality has forced most sell-side analysts to model adj. EBITDA breakeven only in 2024 for Grab. One would imagine just to maintain their market share Grab will have to spend significantly. The argument here is that the Grab can use its profitable mobility business to fund the losses in delivery, but to put this competition in perspective, it appears that Mobility will generate ~$350MM in EBITDA in 2021, and probably over in $500MM in EBITDA next year. Sea Limited, which uses a similar strategy (fund losses in Shopee via gains in Garena) will have generate over $2.5bn in EBITDA from Garena over the next twelve months. Certainly, Sea has several geographies and business lines to spend that money over, but so does Grab.

While I think Grab will continue to be a leader in delivery in the region, it is not a given that they will hold on to their market share in the space. That said, they do have a healthy balance sheet of over $5bn in cash (and several billion more coming post combination) to continue the fight.

Financial Services

The financial services business has had a decent, but not a blockbuster first 9 months. Overall Total Payment Volume (TPV) has grown on average 44% each quarter, however most of that growth has come from On-Grab transactions (someone using GrabPay to pay for a Grab service). Off-Grab transactions have grown around 22% yoy but have largely been flat quarter on quarter during 2021. Now this is likely due to lockdowns, after all you can’t use GrabPay at a restaurant if you can’t go to the restaurant, so it remains to be seen if the tepid growth in off-Grab transactions will improve in 2022 (I suspect it will).

The actual impact to the top line has been muted, with total Adjusted Sales less than ~$75MM in 2021. Further if you just compare IFRS Revenues, in Q3, Financial Services grew just 16% year on year. Considering that a significant portion of the market’s valuation of the company is driven by this segment, it will have to start to produce results.

The upside on Financial Services is significant however, if executed well. Lending business, if priced correctly, are highly profitable, as we can see from tech giants in other regions (ie Mercado Libre). Further, by offering drivers insurance and other add-ons, Grab can ensure that they can improve margins in both the mobility and delivery segments. Again though, like delivery competition in this space is fierce, and we’ve already seen victims such as Razer who have already abandoned their wallet/payment hopes in the region.

As you can see from above, Grab is competing in Indonesia (Southeast Asia’s biggest market) against Sea Ltd, Alibaba, GoTo, and the local state (LinkAja). Further its not typical for customers to be attracted to a super-app primarily because of financial services. Typically, this segment is an add-on product that apps can sell to their existing customer at almost no customer acquisition cost. Thus, it’s imperative for this segment to succeed that deliveries and mobility continue to do well.

Overall though, this, in my opinion is where Grab could see the most upside w.r.t to revenues. The JP Morgan report referenced above for now only has Financial Services delivering only $334MM in GAAP revenue by 2024. If that’s true, then it’s hard to get excited about this business considering it will contribute at best 10% of revenues even several years down the line. This may prove conservative. If executed well, Grab could surprise on the upside, which is very possible in a severely underbanked region.

A few more items…

There were a couple of items in the Q3 Earnings report that we wanted to touch on that we thought were interesting.

Monthly Transacting Users decreased 7.5% year on year, adjusted for lockdowns in Vietnam, this number was up 4%, which implies slow growth in other countries. It’s important to see this growth pickup again considering how low penetration is. As of Q3 Grab had 22.1MM monthly transacting users whereas Southeast Asia has a population of over 600MM.

Appointment of Alex Hungate as COO. According to management Hungate will be responsible for “our Mobility, Deliveries, and Financial Services businesses, as well as our Marketing and Grab Support functions.” This is a huge role. My issue here (without ever meeting the man) is that Hungate comes from SATS. SATS is responsible for ground-handling and in-flight catering at Singapore’s Changi Airport. Prior to Covid this company grew at 4-5% a year and had a reasonably protected position (previously owned by SIA now 40% owned by Temasek). While I’m sure Hungate is extremely competent, I do wonder if Grab requires someone who is battled hardened in high-growth competitive industries rather than someone who comes from a more traditional and low-growth environment but provides an air of professionalism to the company. I could be totally wrong here, but the appointment does give me pause.

On to Valuation …

This will be a quick one as we don’t really want to get into any sort of right ‘price’ for the stock so not to deem any of this writeup as advice. Further, accounting in this industry varies greatly. Some companies present revenues before incentives, some after certain incentives, and some after all incentives. Grab also no longer gives a adj. revenue number, but rather a Gross Billing number and a IFRS Revenue number (which is after all incentives). Thus, it probably only makes sense to compare these companies to their EBITDA numbers. However, this also creates a problem as Grab isn’t expected (as per consensus estimates) to put up consolidated positive EBITDA numbers till 2024.

But anyway, we’ll make do with what we have. Below are consensus growth and EBITDA estimates for 2024.

Overall, it seems Grab is expected to grow above average and has a cheaper multiple than average. Do note that this is after a significant drawdown in stock price and implies that at $10 (which was the SPAC price), the company was probably overvalued on a relative basis, and now the market has brought it to more reasonable levels (don’t tell me the market isn’t efficient!).

Remember though, not all the above comparisons have exactly equivalent businesses, also this is a relative valuation – the market is unforgiving now and has been knocking down anything even remotely related to growth, so take any valuation here with a pinch of salt. But in case it helps, Wall Street is placing price targets on the company anywhere from $12-13 (a lot of street estimates are also based on relative valuations, so if those valuations improve/decline, in theory so should Grab’s according to analysts).

Conclusions:

Overall, I think Southeast Asia is Grab’s to lose. They have a dominant market share in deliveries and mobility and can potentially ramp up Financial Services (especially via the banking license they’ve won in Singapore). The risk here is they are up against battle ready competitors who have just as much if not more money to spend and won’t backdown easily. Grab needs to focus on bringing on more transacting users, surprising investors on the upside on financial services, and increasing absolute profitability in Mobility. That said, I would love to see how Grab operates in at least one covid-free year where each of their business have an opportunity to fire on all engines. It would be the true test if the company still has the fight-in-the-trenches spirit I remember, or if they let their lead slip-away.

Thanks for reading - and happy investing!